In the age of digital transformation, Artificial Intelligence (AI) has moved from a futuristic concept to a core business imperative. Companies worldwide are pouring billions into AI initiatives, driven by the promise of unprecedented efficiency, innovation, and competitive advantage. Yet, a persistent challenge remains: proving the **AI Strategy ROI** (Return on Investment). For many organizations, the initial enthusiasm for AI projects often gives way to frustration when attempting to quantify the financial and strategic value delivered.

This difficulty stems from the nature of AI itself. Unlike traditional IT projects with clear-cut cost savings or revenue streams, AI’s value is often diffuse, long-term, and intertwined with complex organizational changes. It’s not just about a single financial metric; it’s about a holistic transformation that touches every part of the business, from customer experience to employee productivity. To truly succeed, businesses must move beyond simplistic calculations and adopt a sophisticated framework for measuring **AI Strategy ROI** that accounts for financial, operational, relational, and strategic gains.

This comprehensive guide will provide the definitive framework for calculating, measuring, and maximizing your AI investments, ensuring your AI strategy delivers tangible, sustainable value.

Table of Contents

The Shifting Definition of AI Strategy ROI: Beyond Simple Math

The first step in maximizing **AI Strategy ROI** is acknowledging that the traditional ROI formula—(Gain from Investment – Cost of Investment) / Cost of Investment—is often inadequate for AI. This is a critical point that separates successful AI adopters from those who struggle to prove value [1].

The Three Common Mistakes in Measuring AI Value

Leading consultancies like PwC highlight three common pitfalls organizations fall into when evaluating their AI initiatives [1]:

- Simple, Single-Point ROI Calculation: This approach focuses only on hard investments and hard returns, failing to consider the uncertainty, error rates, and potential cost of mistakes inherent in AI systems. For example, an AI system that miscategorizes a high-severity customer complaint can lead to significant, unquantified customer churn.

- Single Point-in-Time Measurement: AI models, particularly those based on machine learning, are not static. Their performance can degrade over time, a phenomenon known as “model drift.” Measuring ROI only a few months after deployment ignores the critical need for continuous monitoring, maintenance, and retraining, which are essential to preserve the AI’s long-term potential.

- Treating Projects in Isolation: Viewing each AI project as a siloed investment misses the cumulative, synergistic value of an overall AI portfolio. A true AI strategy recognizes that individual projects often build upon shared data infrastructure and capabilities, making the total value greater than the sum of its parts. This portfolio approach is key to building a robust AI Strategy Consulting practice.

Hard ROI vs. Soft ROI: The Holistic View

To overcome these challenges, a successful AI strategy must measure both **Hard ROI** (financial and tangible metrics) and **Soft ROI** (strategic, operational, and cultural metrics). The true value of AI often lies in the soft metrics, which act as leading indicators for future hard returns. This holistic view is a core component of a successful AI Business Strategy.

Table 1: Hard vs. Soft Metrics for AI Strategy ROI

| ROI Type | Focus | Examples of Metrics |

|---|---|---|

| Hard ROI | Direct Financial & Operational Gains | Cost Savings (e.g., reduced labor hours), Revenue Increase (e.g., higher conversion rates), Time-to-Market Reduction, Error Rate Decrease. |

| Soft ROI | Strategic, Cultural, and Future-Enabling Value | Employee Satisfaction/Retention, Customer Lifetime Value (CLV), Data Quality Improvement, Process Agility, Risk Reduction, Time Saved on Decision-Making. |

Building a Robust AI Value Realization Framework

To capture this holistic value, organizations need a formal framework that aligns AI investments with core business objectives. This is where the concept of a Value Realization Framework comes into play, moving beyond simple project-level ROI to a strategic, enterprise-wide view [2].

The Four Dimensions of AI Value

A comprehensive framework for **AI Strategy ROI** should assess impact across four interconnected dimensions: Financial, Operational, Relational, and Strategic [3].

- Financial Value: This is the most traditional dimension, focusing on direct monetary impact. It includes measurable gains in profit, revenue, and cost reduction.

- Operational Value: This focuses on the efficiency and effectiveness of internal processes. Metrics here include cycle time, throughput, resource utilization, and quality improvements.

- Relational Value: This dimension measures the impact of AI on external stakeholders, primarily customers and partners. Key metrics include Customer Satisfaction (CSAT), Net Promoter Score (NPS), and Customer Lifetime Value (CLV).

- Strategic Value: This is the long-term, future-enabling value. It includes the creation of new business capabilities, enhanced data governance, improved organizational agility, and the ability to enter new markets.

By defining metrics within each of these four areas, a business can create a balanced scorecard for its AI initiatives, ensuring that a project delivering low immediate financial ROI but high strategic or relational value is not prematurely terminated. This approach is essential for any organization looking to scale its AI efforts and is a key lesson from successful AI adoption strategies.

Quantifying the Hard ROI: Financial and Operational Metrics

While the soft metrics are crucial, the hard financial and operational returns are what ultimately justify the investment to stakeholders. The key is to establish clear, measurable baselines before implementation and track the delta rigorously.

Cost Reduction Through Intelligent Automation

One of the most immediate sources of **AI Strategy ROI** is the reduction of operational costs through automation. This is not just about replacing human labor, but about automating repetitive, high-volume tasks that free up human capital for more strategic work.

- Process Efficiency: AI-powered tools can automate tasks like data entry, invoice processing, and customer support triage. For example, a global financial services firm used a machine learning model to automate compliance checks, reducing the average time per check by 60% and saving millions in labor costs [4].

- Predictive Maintenance: In manufacturing and logistics, AI algorithms analyze sensor data to predict equipment failure, allowing for maintenance to be scheduled precisely when needed. This minimizes unplanned downtime—a direct and significant cost saving. Tools like DataRobot (a leading Automated Machine Learning platform) can be used to build and deploy these predictive models, offering a clear path to operational ROI.

Revenue Generation and Optimization

AI’s impact on the top line often comes from hyper-personalization, dynamic pricing, and optimized sales processes.

- Personalized Customer Journeys: AI algorithms analyze vast amounts of customer data to recommend products, content, or services with high precision. This leads to increased conversion rates and higher average order values. For instance, a major e-commerce platform reported a 15% increase in revenue directly attributable to its AI-driven recommendation engine [5].

- Dynamic Pricing and Forecasting: AI can continuously adjust pricing based on real-time factors like inventory, competitor pricing, and demand signals. This optimization ensures maximum profit margins. Furthermore, advanced forecasting models, often built using Python libraries or commercial platforms like IBM watsonx, provide more accurate demand predictions, reducing waste and overstocking.

To accurately measure this financial impact, organizations must isolate the effect of the AI system from other variables. This often requires A/B testing or controlled experiments, a practice that must be baked into the **AI Strategy ROI** plan from the outset.

Measuring the Soft ROI: Strategic and Cultural Impact

The most profound and often overlooked source of **AI Strategy ROI** is the soft, strategic value that enables future growth. These metrics are harder to quantify but are the foundation of long-term competitive advantage.

The Impact on End Users and Staff

The Forbes Business Council identifies metrics related to employee experience as a key component of AI ROI [6]. AI should not just save time; it should improve the quality of work and reduce friction.

- Reduced Cognitive Load and Burnout: By automating tedious tasks, AI reduces employee burnout and improves job satisfaction. This can be measured through employee engagement surveys and staff retention rates. High retention is a direct financial benefit, as the cost of replacing a skilled employee is substantial.

- Decision Velocity and Quality: AI provides employees with better, faster insights, leading to quicker and more accurate decisions. Metrics include the time saved on research or analysis (e.g., 30% faster decision-making cycle) and the reduction in decision-related errors. This is a crucial factor in building a high-performing AI-enabled organization.

Data Governance and Infrastructure as a Strategic Asset

A significant hidden return from AI investment is the forced improvement in data quality and infrastructure. AI models are only as good as the data they are trained on, meaning any serious AI project necessitates cleaning, structuring, and governing data assets.

The resulting high-quality data infrastructure becomes a strategic asset in itself, enabling future AI projects and improving the performance of all data-driven initiatives. This strategic return can be measured by metrics such as:

- Data Quality Score: A quantifiable measure of data completeness, accuracy, and consistency across the enterprise.

- Data Accessibility Index: The time it takes for a new team to access and utilize a specific dataset for a new project.

Improving these foundational elements is critical for future innovation and is a strong indicator of a mature AI governance framework.

From Strategy to Sustained ROI: The Long-Term View

Achieving a positive **AI Strategy ROI** is not a one-time event; it is a continuous journey that requires a long-term commitment to maintenance, monitoring, and portfolio management. Gartner emphasizes that benefit realization is a continuous process that must be baked into the AI lifecycle [7].

The Imperative of Continuous Monitoring and Maintenance

The phenomenon of model drift—where an AI model’s accuracy degrades as real-world data patterns change—is the single biggest threat to sustained AI ROI. A successful strategy must budget for and implement continuous monitoring.

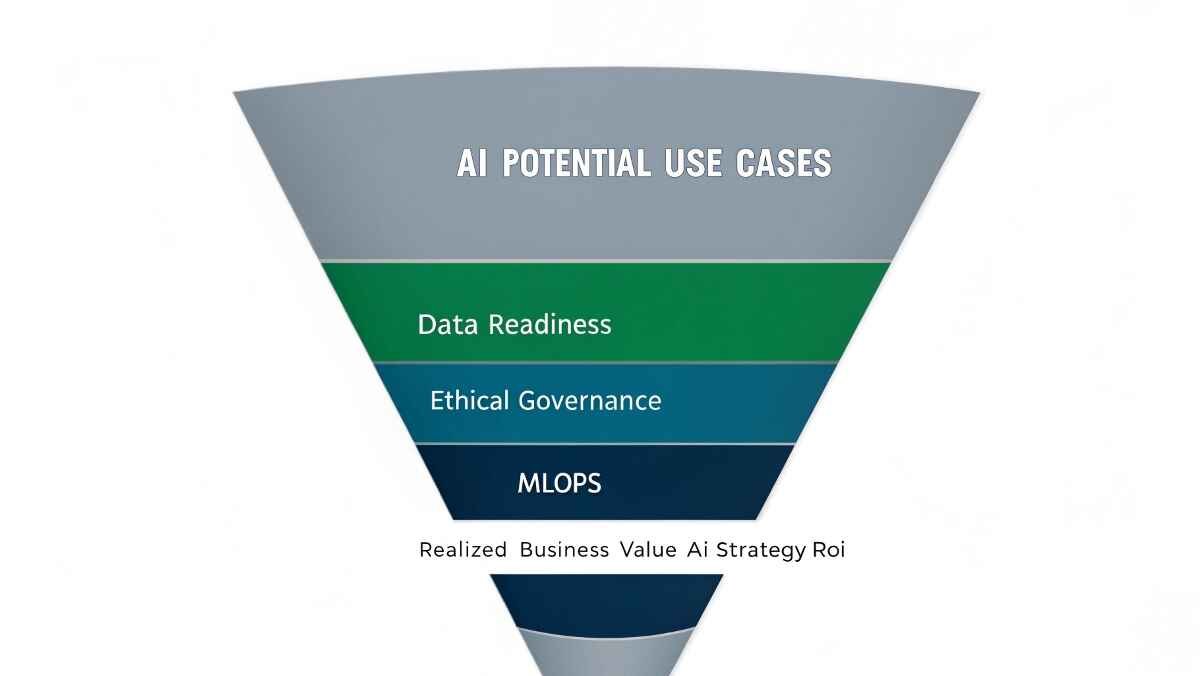

This involves setting up MLOps (Machine Learning Operations) pipelines that automatically track model performance against key business metrics. When performance dips below a predefined threshold, the system should automatically alert teams to retrain the model with new data. Failing to do this is equivalent to installing a high-value piece of machinery and never performing maintenance—the return will inevitably decay. This continuous loop of deployment, monitoring, and retraining is what ensures long-term AI value realization.

Adopting a Portfolio Approach to AI Investment

The most successful companies view their AI investments as a portfolio, not a series of isolated bets. This means:

- Cross-Pollination of Learnings: Insights from one project (e.g., a successful data pipeline) are immediately applied to others.

- Risk Diversification: A portfolio can absorb a few low-ROI projects if they are strategically necessary (e.g., building a foundational data layer) or if they enable a few high-ROI projects (e.g., a new revenue-generating application).

- Strategic Alignment: All projects are measured against the four dimensions of value and aligned with the overarching business strategy, ensuring that every dollar spent contributes to a unified goal.

This strategic oversight is what allows organizations to scale AI from a handful of proof-of-concepts to a true enterprise capability, ultimately maximizing the total **AI Strategy ROI** across the entire business [8].

Conclusion: The Future of AI Strategy ROI

The challenge of measuring **AI Strategy ROI** is a reflection of AI’s transformative power. It demands a shift in mindset from simple, project-based financial accounting to a sophisticated, holistic Value Realization Framework. By diligently tracking hard financial gains alongside soft strategic and cultural impacts—and committing to continuous monitoring and a portfolio approach—organizations can move beyond the hype and unlock the multi-trillion-dollar potential of AI.

The future of business success will be defined not just by who adopts AI, but by who masters the art and science of measuring and maximizing its return.

References

- [1] PwC. (2021, July 20). Solving AI’s ROI problem. It’s not that easy.

- [2] ISACA. (2025, March 3). How to Measure and Prove the Value of Your AI Investments.

- [3] Innovaition Partners. (2025, September 30). The ROI of Intelligence: A Definitive Guide to Measuring AI Value.

- McKinsey & Company. (2025, March 5). The state of AI: How organizations are rewiring to capture value.

- McKinsey & Company. (Unknown). The economic potential of generative AI.

- Forbes Business Council. (2025, May 7). 19 Ways To Measure The ROI Of Your AI Initiatives.

- Gartner. (2023, June 7). Capture AI Value With These 5 Benefit Realization Best Practices.

- McKinsey & Company. (2025, January 28). AI in the workplace: A report for 2025.